The KOF-EXPERTS.SN Concept

Our history

KOF-EXPERTS.SN is a chartered accountancy business registered with the Ordre des Experts-Comptables de Paris and the Ordre National des Experts-Comptables et Comptables Agréés du Sénégal (ONECCA). It was founded in 2015 by Mr. Souleymane Diarra, a mandatory auditor and chartered accountant.

Having worked for prominent Parisian organizations for more than two decades, Mr. Diarra possesses extensive knowledge in all aspects of accounting, auditing, and finance. He has managed intricate projects, significant customer accounts, and thorough audits throughout his career. Mr. Diarra pledged to use his expertise to advance Africa’s development, with a special emphasis on Senegal, after gaining this extensive and diverse experience. This is how the company was founded, with the intention of providing excellent chartered accounting services and actively promoting regional economic growth.

Our services

Perfect knowledge of your business

Accounting expertise

For more than 9 years, we have been helping company directors to manage their...

Legal, tax and employment

The decisions taken are linked to the legal and tax framework of your business...

Council

A manager's life is made up of strategic choices: recruiting, exporting, investing, etc.

Audit

Ensure regulatory compliance, strengthen stakeholder confidence and improve risk management...

KOF-EXPERTS.SN in figures

Our firm is present in several towns in Senegal, which enables us to serve you better, to be as close as possible to the entrepreneurial ecosystem in order to better master the challenges you face. But it also gives us the opportunity to participate in the development of several local companies, in the sub-region, in Europe and in America with our new office recently opened in partnership with Moore Canada.

*** Translated with www.DeepL.com/Translator (free version) ***

Blog

Enlightened Explorations

Preparing for a Job Interview at an Accounting Firm

"I've landed a job interview! Not just any interview, but one at an accounting firm. Where do I start? How should I approach it?"

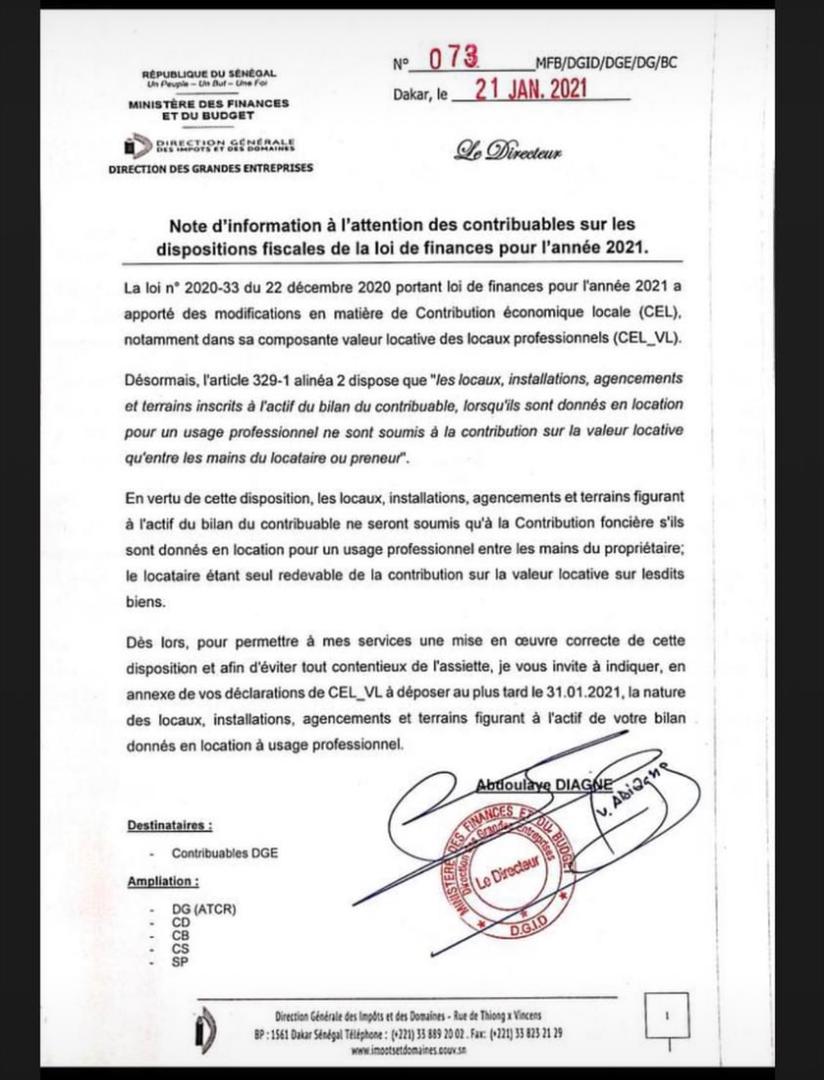

Information on CEL VL

Law no. 2020-33 of December 22 introduced changes to the Contribution Economique Locale (CEL VL).

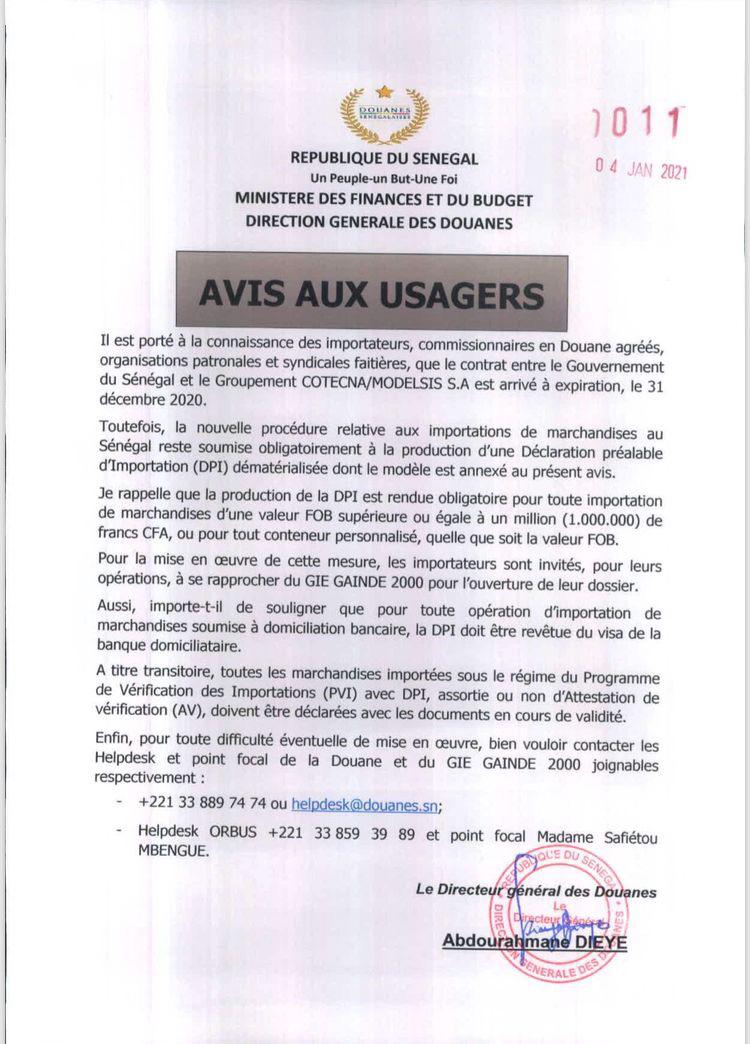

User notices/ Imports

It is brought to the attention of major players, authorized customs agents, employers' organizations and trade unions.

Technical Note on Leaves in Senegal

The taxpayer concerned will have to produce the provision statement (cf. Art. 31.4-2 CGI).

Technical note on vat in Senegal

The taxpayer concerned will have to produce the provision statement (cf. Art. 31.4-2 CGI).

Technical note on the legal and tax status of domestic servants in Senegal

Article 1 of decree no. 974 of January 23, 1968 on the employment of domestic servants and housekeepers in Senegal defines domestic servants and housekeepers as "any employee employed in…

Technical Note on Some Legal and Tax Aspects

A partner's current account can be defined as “a contribution in the form of a current account in which the partner makes advances or loans to the company by paying…

The Unified Global Contribution (UGC) in Senegal

Law No. 2004-12 of February 6, 2004, amending the CGI and instituting the Unified Global Contribution (CGU) in Senegal

Tax and social security liabilities February 2021

Payment of January 2021 IPRES contributions for companies with 20 or more employees.

We can help you find the financing you need

Thanks to our ecosystem of experts and partners, we operate in a wide range of business sectors.